Insurance Terminology 101: “Approvals” and “Authorizations”

One commonly misunderstood concept about insurance coverage is the term “approval.” It seems pretty simple, but many people think that having a service approved by their insurance plan means that they will not have to pay for the service. While that is possible depending on the situation, the most often result is that the patient is left surprised and confused when they ultimately receive a bill for an “approved” service. This post is part of a series to help patients clarify the terminology that your insurance company is using so they can better understand their coverage.

Approval / Authorizations

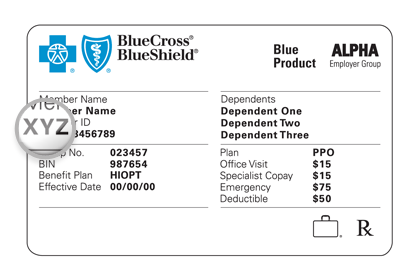

Approval by an insurance plan means that they will allow you to get something done and will at least consider paying for the test. This does not mean that your health insurance will pay for the test – it means they agree that the procedure will be subjected to the benefits listed on your insurance plan. Authorizations are essentially the same thing as approvals, but you’ll hear authorizations more often with prescription coverage details. Just like approvals, a prescription authorization only means your insurance benefits will be applied to the claim for your prescription and does not guarantee payment.

While you may still be paying for an approved service, your insurance company at least acknowledges that this test or medication is generally recommended for your particular medical situation and should be considered as part of your plan’s benefits. They are not saying they won’t pay yet, but they also aren’t saying they will pay, either. This is the first chance in the claims process for your insurance company to get out of paying for a service, so getting this approval is a good first step.

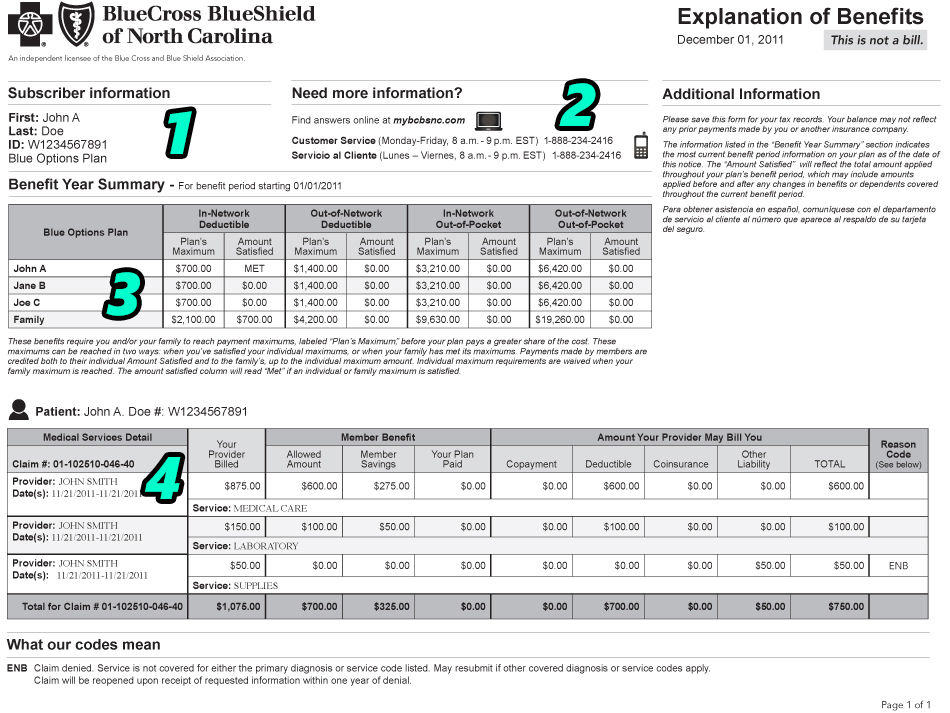

However, obtaining an approval does not mean you will not still owe up to 100% of the service you are approved to receive. Your benefits for an approved service could include deductibles, coinsurances, copayments, and additional out-of-pocket expenses that you will have to pay the service’s provider. If you have a high deductible that has not been met, for example, you will still incur a large out-of-pocket expense for approved services.

—–

Let me know what you think in the comments section below. If there are any other phrases or terms that you sometimes get confused, please send me a message and I’ll try to feature your question on a feature post. Thanks for reading!

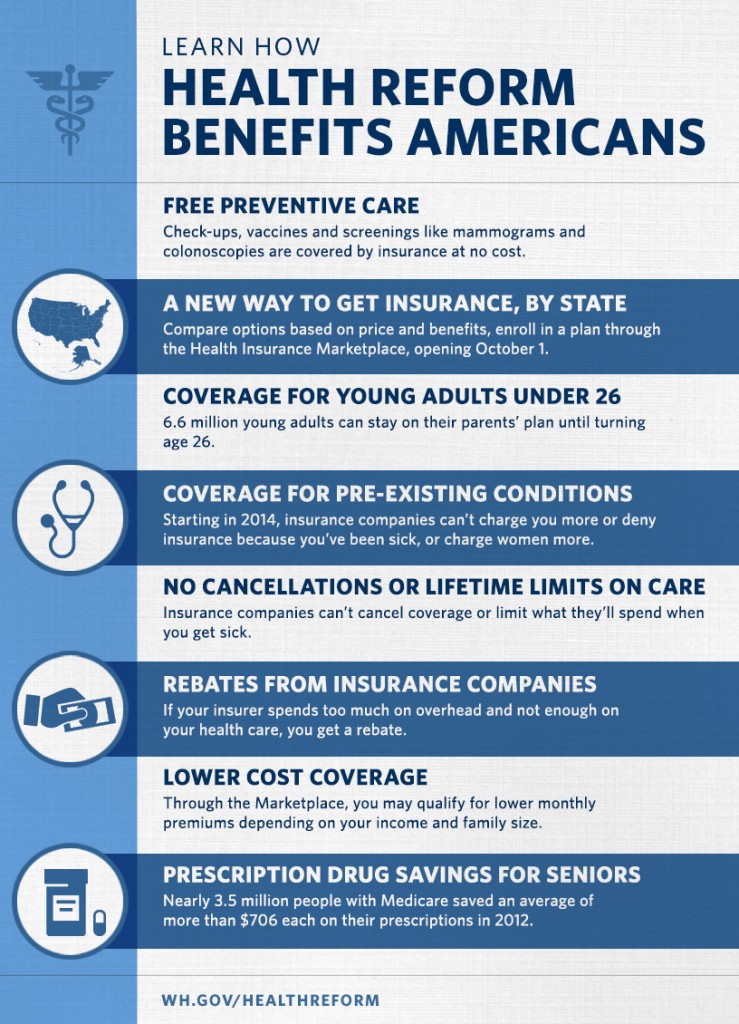

All health plans, including grandfathered plans, must:

All health plans, including grandfathered plans, must: