This is the third in a series of posts about the insurance claim filing process. The process can be daunting and seem confusing, but the basic components are fairly easy to understand if you break them down individually. The goal is to help our patients, and everyone else, understand what is actually happening “behind the scenes” when you use your health insurance. You can read the rest of the series by clicking on the link headers at the bottom of the post.

Determining Patient Responsibility

After covering the broader details of the Explanation of Benefits (EOB) letter here, this post will go into more detail regarding the most important piece of information to the patient – the amount of money they owe in out-of-pocket expenses. The rest of the information on the EOB is useful and helpful for various things, but most people can get away with ignoring that information and focusing strictly on the bottom line. In the insurance claim process, the “Patient Responsibility” portion of your EOB represents the “bottom line” financial responsibility of the patient in the claim process.

There are generally four ways a charge from your medical provider could become classified as Patient Responsibility and result in out-of-pocket expenses owed by the patient.

- Patient owes co-payment. This is most common for standard insurance plans that have a set dollar amount listed on the patient’s insurance card. Co-payments are usually tiered to have higher amounts owed for higher level of services, so the actual amounts could vary significantly by the provider and facility you used. For example, your card could say you owe $20 for a primary care visit or $50 for specialist visit. If you visit that type of provider, you can expect to owe at least your co-payment amount for most services. Depending on the type of service provided (eg. Surgeries, EKGs, Lab Services, etc.), the patient could be potentially responsible for both a co-payment and one of the following other possibilities, so do not assume that the co-payment is always the most you will pay for a certain provider.

- Patient owes deductible. The concept of a deductible will eventually be its own post in this series to allow me to go into more detail on one of the most complicated features of health insurance plans, but the basic idea is this – the patient owes the full amount of their deductible before their insurance will start to pay for any of their healthcare expenses. If you have not met your deductible yet, you will probably owe the entire Allowed Amount of the insurance claim until you have met your deductible. You can track your progress towards meeting your deductible by referencing the Plan Summary section of your EOB, as well. There are plenty of exceptions to that rule that I will cover later, so make sure you understand your plan and the way your benefits are applied for certain types of services.

- Patient owes co-insurance. This is basically the same as the concept of a co-payment, except a set dollar value is replaced by a percentage of the Allowed Amount. For example, instead of having a set $20 co-payment for a primary care visit, your plan could require you to pay 20% of the total charges from the visit. There are usually capped annual co-insurance maximums, as well, just like the deductible, that limit the amount of out-of-pocket expenses to a set maximum each year. Most commonly, co-insurances are added on top of co-payment plans and only applied to certain facility-level charges, like lab work or radiology expenses. It is very common for a plan to have both a co-payment and a co-insurance structure, so be sure to check how and when that might apply to your charges. Since the Allowable Amounts of certain services can vary significantly, this could be a good or bad thing for the patient.Here is a table with comparison between two common structures, a tiered co-payment plan and a standard co-insurance plan, and how a sampling of average charges for certain services results in different levels out-of-pocket expenses:

| Total Allowed Amount Of Claim | Amount Owed With Standard Co-Payment | Amount Owed With 20% Co-Insurance | |

|

Primary Care Visit |

$80 | $20 | $16 |

| Specialist Visit | $300 | $50 |

$60 |

| Hospital (ER) Visit | $5,000 | $250 |

$1,000 |

- A line item on the claim was denied. This is pretty much the worst thing that could happen to your insurance claim and the only real possibility you have to get your total Patient Responsibility reduced. If your claim says that you owe your co-payment, deductible, or co-insurance, your plan benefits were likely applied correctly and within the structure of your contract with your insurer. Basically, you signed up for a plan that said you would pay this much, so now you have to pay it. However, situations where certain line items were denied, non-covered, or listed as having “other” reasons for Patient Responsibility are the real chances you have to potentially make corrections and reduce the amount you owe. Since the process for handling denials and filing appeals is pretty lengthy, those two topics will be covered separately at the end of this series.

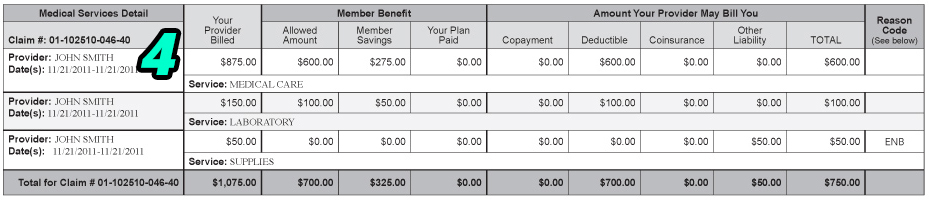

Here is an example from our sample EOB from the last post.

In this example, John Doe ultimately became responsible for $750 worth of medical expenses for his visit with Dr. John Smith. His plan showed he had a $700 deductible (as shown in the Plan Summary section of his full EOB), so if this was the first claim Mr. Doe had towards his deductible on the year, the claim was processed correctly and Mr. Doe became responsible for full payment of the first $700 in his health expenses for the year. If Mr. Doe went back to Dr. Smith and had the same services later on in the benefit year, he could then likely expect his insurance to cover those services “after deductible” since he has now met his annual deductible.

The remaining $50, however, is questionable – it is labeled as Supplies, so it could have been something deemed Not Medically Necessary by his insurer. The denial code stated that the reason for denial was due to a non-covered diagnosis code. Mr. Doe could potentially see if there is a possibility for re-filing with an alternate code or see if there was a mistake in how his benefits were handled for that line item, but more information about what the Supplies actually were would be needed to make that determination. While there is a path to potentially appealing denied line items, the $700 owed for the deductible is unlikely to be reduced by any subsequent actions by Mr. Doe (with plenty of possible exceptions, of course). That is probably where he should start when trying to reduce his Patient Responsibility for this claim.

This was a basic summary of situations where medical expenses could potentially be deemed Patient Responsibility. This is the third post in a series on understanding the insurance claim process. There will be more details regarding the topics I only summarized, such as deductible balances, claim denials, and claim appeals, later on in this series. In the rest of the blog posts in this series, I will explain the specifics involved in your EOB, including detailed information on the following topics:

- What is an Explanation of Benefits Letter?

- Basic EOB Terminology

- Determining Patient Responsibility

- Determining Plan Details

- Accessing Online EOBs

- Understanding Denials and Denial Codes

- How To File an Appeal

If you have any specific questions or topics you would like us to discuss, please mention them in the comments below and we will address them in future posts. If you are a patient at Family Care and have any questions about EOBs you received for claims from our office, please let us know by filling out our contact form. Thank you!

I work for an Ophthalmology clinic and we have never collected deductibles prior to patients appointments or surgeries. What would be the best plan of action to start collecting the deductibles?

Is this something that our office would call the patients prior to the appointment and go over the policy to make sure that they are aware that they would owe the amount. Also, every insurance has an adjusted amount. How would we know how much the adjusted about would be. We are a very small office and do not have alot of man power to spend on this issue but I need a policy in place for the deductible

Thank you

Dawna

Hello! Collecting deductibles at the time of service will take a lot of the burden off your billing & collections process, so it should help improve your workflow. The adjusted amount from your insurance is a part of the contract you signed with the insurer, so you should be able to reference that document and set the proper amount for each individual insurance. The fee schedules are available on most insurance provider eligibility and claims portals, or you can always just start collecting data yourself from returned claims from each insurer. You can verify if a patient has met their deductible by verifying their benefits, preferably online but it is also possible over the phone.

Basically, confirm if the patient has met a deductible. If they haven’t collect 100% of the adjusted insurance rate for whatever service you provide up front. Once the claim has been filed/processed, you can adjust and discrepancies and either send the patient a refund or use their over-payment as a credit for the next visit. Posting the policy and having patients sign a document stating that they are aware of the process should be sufficient for notice, but you’re likely to have some push back from patients who are used to a certain way of doing things. I’d suggest being flexible with them for the first 6-12 months of the “pay up front” policy, but just reminding them of it every time so that they’ll eventually get used to it. Good luck!

Hello. How do I determine the patient responsibility when there’s no paid amount deductible or coins

It sounds like you may not be looking at an Explanation of Benefits, unfortunately. Perhaps, you are looking at a receipt or invoice? The EOB should always have some type of information about how the claim was processed. When in doubt, call your insurer and they can explain your responsibility or have an EOB re-issued. Good luck!

Medicare paid and applied the balance of $114.00 towards the member deductible, then AARP was billed as secondary, and denied saying the policy did not cover this service with a PI- denial. The balance of $114.00 would be billed to the patient, correct?

That sounds correct, but there really should be a way to get AARP to accept the claim as secondary. Primary processing always applies over secondary processing, but there may be an issue with the secondary claim that you can fix to help the patient receive those benefits, as well. If you find that everything was correct and there is no hope with the secondary claim, the patient would owe $114.

RB

do you have the aarp website. if you look on there it will probally say something like that your plan does not cover the medicare part B deductible.

If the patient has a Copay (not coinsurance) but has NOT met their deductible, will the patient ultimately be responsible for the insurance’s “allowable amount”? Because I have billed this same insurance and code before, I know what the allowable amount is, example $100, and the patient has a copay of $25, and I know they have not met their deductible, should I ask for the full $100 even though they have a $25 Copay? I would think there will be a “patient responsibility” on the EOB of $75 when I get it from the insurance company. I feel I should collect it in advance if I truly know the information to lower the burden of the patient accumulating a large patient responsibility down the road.

Thoughts?

If you are absolutely certain they will owe $100, I would go ahead and ask to collect the payment up front. Especially if you have a recent / same benefit period claim that has already been applied to a deductible, you can be pretty confident that is how the insurer will process the claim. We generally ask for payment up front in that case, but also are completely fine with the patient only paying the $25 copay up front if there is any doubt. We will let them know at checkout that we’re collecting $25, but expect they’ll owe $100, so they aren’t as surprised by a bill. You just have to be diligent about refunding overpayments or explaining how it could be used as a credit for future visits in that case, but it is much easier to give money back to patients than it is to collect it in the first place. I’m surprised by insurances all the time and the timing of when claims get processed can make your estimates worthless (eg. they went to the ER the day before, but haven’t had that claim hit their deductible yet). Just go with the best information you have at the time and let the patient know what you’re expecting to happen, then you should be fine!

Okay this phrase on the BCBS EOB has me stumped. to bill or not to.

Charge is $148.00, primary left their allowed amount applied to deductible of $85.67 (UMR) and then BC as 2ndary has their allowed amount is $133.42 and only paid $6.68 and the statement has: PATIENT RESP.*INCLUDES OTHER INSURANCE PAYMENT AMT* would that no mean that the patient still owes their Deductible of $85.67?

Primary processing always takes precedent over secondary, so I would expect the $85.67 number to be correct in this case. The $6.68 from the secondary insurance seems to ignore the allowed amount from UMR, so there may be some type of adjusted rate there from BCBS. It seems to be pretty close to 15% of the non-allowed rate, which is a common secondary benefit level, so that might be my best guess. The patient should definitely owe you $85.67, but it looks like you’ll owe the patient $6.68 back from the secondary, so you’d charge the patient $78.99 total. May want to look into the patient’s secondary benefits on the BCBS plan to confirm, but that seems right given this information.