How do I know if I am being billed the correct amount for my visit?

As most people can understand, figuring out exactly how much a particular medical service will cost can be extremely difficult. There are a lot of variables that factor in to the final cost of any care you receive, but it is still possible to get pretty solid information and set reasonable expectations for the most common types of services you will encounter. This post is designed to help you understand the basics of the billing process to help you identify any problems and know learn how to fix them.

When you are billed by any medical provider, they are usually working with the best possible information they can get about your insurance coverage at the time of service. However, regardless of how well they might be able to predict your coverage, providers are often still sometimes just as surprised as the patient when dealing with unexpected changes in coverage and quirks with different insurance plans. Because of this uncertainty, the amount you pay at the time of service may differ from the amount you actually owe.

No matter how much your provider may try to help navigate your insurance policy, the ultimate responsibility for the balance of a denied claim belongs to the patient. The total amount you will owe is called “patient responsibility” because you’re the one who will have to pay the bill and ultimately responsible for ensuring that you are paying the correct amount. Billing errors aren’t common, but they do happen and can be fixed pretty easily if you know how to find them.

PATIENT RESPONSIBILITY

There are three things that you’ll need to keep track of to know for sure if you are being billed the correct amount by your provider.

- The amount you paid at the time of service.

- The amount your explanation of benefits stated you would owe.

- The amount of the bill you receive from your provider.

Ideally, #1 and #2 are equal and #3 never happens because you’ve already paid the correct amount for the service you’ve received after the appointment. For standard visits and simple insurance plans with copayments instead of deductibles, this is usually pretty easy. Your insurance says you’ll owe $25 for a visit, so you’ll pay your $25 when you check out and know that the rest will be covered. Easy. Unfortunately, there are far more instances where deductibles, co-insurances, exclusions, and other insurance hurdles will also apply to your benefits and make things more difficult to predict.

These types of “high deductible / shared percentage” plans are becoming much more common and make up all of the possible options available on the health exchange for Durham County in 2017. Because the total bills you’ll receive for these kind of plans are very much dependent on factors that you can’t guarantee before the service is rendered, the amounts you are charged for certain services are much more unpredictable.

This is where a basic checklist comes in handy:

#1. Remember what you paid.

Because most FSA plans now allow you to submit an electronic PDF of your receipts for tax purposes, you probably don’t need to save a real paper receipt of your transaction. However, you will still need to keep track of how much you’ve paid, just like any other bill you might have. You can also always refer back to your credit card statement or look at your online banking history to reference the charges, if needed. Either way, if you actually get a bill, you’ll want to look up previous payments towards your expected out-of-pocket expenses for that service and make sure they are already deducted from your total balance.

#2. Check your Explanation of Benefits (EOB).

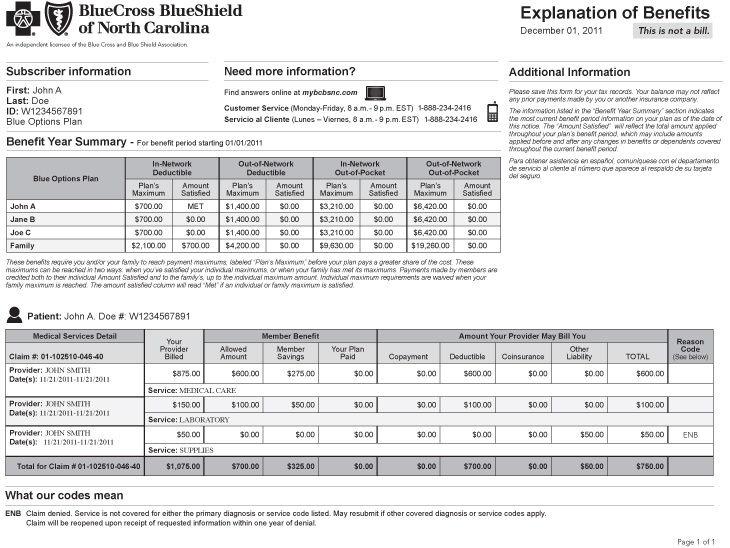

This is a statement issued by your insurance company and either mailed or uploaded to your online member services account about 2-3 weeks after every claim filed on your behalf by a medical provider or facility. Your final out-of-pocket expenses are usually listed under a column titled “total patient responsibility” and will your insurer’s reasoning for each balance owed will be detailed on this document after your insurance benefits have been assigned to your claim. If you receive a bill because your insurer says your plan didn’t pay for something, this document will tell you why.

#3. Check your bill.

If you know what you’ve paid (shown on your receipt) and how much you should owe (based on your EOB), you can pretty much figure out how much you’ll be billed after the service.

Amount owed on EOB – Amount paid at time of service = Amount still owed

There are always exceptions at each facility you visit that may lead to separate fees associated with their services, but those are usually relatively minor compared to the total cost of care. If you think there is a problem with the amount you are being billed, be sure to contact your provider and double check to see if there are any other fees or balances that may have contributed to the difference before attempting to contact your insurance.

FIXING A PROBLEM

So, you’ve looked at your EOB and examined at your bill and the two numbers still don’t match up. Or, worse, they do matchup and the amount is significantly higher than you were expecting. Now that you have identified a potential discrepancy with the bill, what do you do about it? Your first phone call depends on where you find the problem.

My EOB and the bill from my provider both show the same amount due.

This is a problem between you and your insurer. In this case, the problem would be that you disagree with the amount your insurer said you would owe since your provider’s information matches the insurer. This means that the problem lies at the start of the claim process where your insurance assigned your plan’s benefits to the claim they received. You thought you would owe one thing, but your insurance said something else.

Here are the steps you should take to work towards a solution:

- On your EOB, look up the “Remark Code” for the line items that are being denied. These are generally 2 or 3 digit alphanumeric codes that reference a longer explanation of denial later on in the document. This is a summary of the actual reason your insurance is using to deny this charge. If this summary explanation does not make sense to you based on how you understand your policy, you can call your insurance company for a full explanation.

- When you call customer service, be sure to have your insurance card and EOB in front of you so you can reference the date of service, amount billed, and the specific line item that you are questioning. They will be able to look up your insurance policy and re-examine the specific claim you are referencing at the same time to make sure your plan’s benefits were applied correctly.

- If your benefits were applied correctly, the representative can answer questions about your plan and help you understand how your benefits will be applied in the future so you can possibly avoid the same situation next time. Sometimes, payment is denied because they need to update information about your insurance plan, so you can answer their questions over the phone and take care of the balance in just a couple minutes. Learning more about your policy and how your insurance will process a similar claim could make a big difference in the long run.

- If your benefits were not applied correctly, the customer service representative should be able to notice the mistake and submit your claim for reprocessing. If this happens to be the case, you’ll want to get a reference number for the call and notify the provider that sent you a bill. The insurance will likely give you a quote like “we will reprocess this claim and send a corrected claim to your provider in 2-3 weeks.” Whenever they give you a timeframe, double it and then call your provider back to see if everything has been resolved.

My EOB says one amount owed, but the provider’s bill says something different.

If you have carefully looked at your receipt, EOB, and billing statement and still think there is a problem that is unrelated to how your insurance processed the claim, here are several logical explanations, in order of potential likelihood:

- You owed money for another claim. Most of the time, your billing statement only includes claim details for the claims with a balance owed. It is possible that your provider applied part of a payment you’d made to a claim that is not currently on your billing statement because that balance was covered.

- You paid $100 at the time of service, but $40 went towards a balance from January and $60 went towards a balance from April. Because you also owed $100 from the April visit, you may receive a bill for $40 for that claim even though you paid $100 already.

- You owed money for additional fees and services not on the bill. Every practice is different, but there are always additional fees that you may have to pay for services that are not reimbursable by insurance companies. These include charges for things like missed appointments, form completion, records requests, and certain lab tests that aren’t covered by insurances. Part of a payment you made may have been applied to one of these types of charges.

- You had a previous credit applied. Sometimes, the system actually works in your favor and you might overpay for a charge up front. When this happens, you’ll receive a credit on your account that may be applied to future balances and reduce the amount you are charged at the time of service. If you were unaware of the credit, you may have expected a service to be cheaper than you thought when you paid.

- You overpaid by $20 a couple months ago, so your provider only charged you $5 for your usual $25 copayment. When you look at your EOB, it shows that you would owe $25 for that visit, even if you only paid $5 that day.

- There was a mistake. Most financial correspondence between your insurer and provider is electronic and automated, but that doesn’t mean there aren’t mistakes. As the provider, we receive batches of claim data that includes dozens of claim rows and about 20 columns of payment information per claim from the insurer and we have to sift through every row, column, and number to ensure its accuracy. As you can imagine, it is very tough to get through this process and end up 100% perfect. Even at 99.9% accuracy, that means an average primary care facility will generate about 10 incorrect patient balances per month. Before getting upset or worried about the possibility of owing for a service, have your provider double check the claim first before attempting to appeal through your insurer.

You can easily identify which one of these situations is likely to apply to you by asking for a “transactional summary” of all your claims for a certain time period. All providers may call this report something different, so you’ll just need to ask for something that shows all the charges on all claims filed by the provider and how all of your payments were applied to your account over a certain time period. This will let you see, line by line, what caused the problem.

Most of the time, any changes to a bill with an amount that differs from your EOB will always be initiated by the provider who performed the service, so it’s best to start at the source if you want to fix a potential problem. I hope this has given you the knowledge to better understand your medical bills and the confidence to discuss them with your provider, if needed.

If you have any questions related to the content of this article or if you’ve experienced any other type of situation that I didn’t address, I’d love to read your comments below. Thanks for reading!