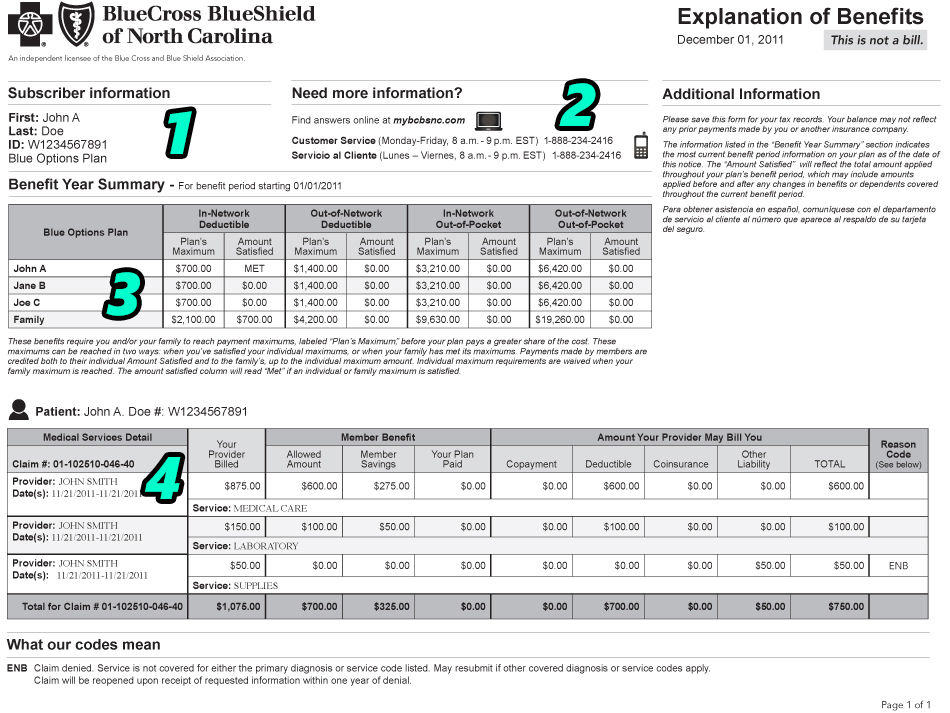

This is a breakdown of the major sections contained in the Explanation of Benefits letter you receive after a medical provider files a claim to your health insurer for medical services provided. More in depth breakdowns of specific terms will be included in future posts on this topic as we finish out the series (outline below).

- Subscriber Information:

This is basic identification information, including the name of the policy holder, type of plan, and member identification number of your insurance policy.

- Contact Information:

If you have any questions on the plan details described in your EOB or the way your insurance plan has processed your claim, this is who you would call. If you have enabled your online account with your insurer, you can also initiate questions by logging in and sending an online message to a customer service representative. The customer service representative will need your Claim Number (detailed in section 4) on any correspondence regarding your claim questions, so make sure you make that prominent in the message.

- Plan Summary

This is a basic summary of your plan’s deductible details and your current progress towards meeting your annual obligations. Most plans have some type of deductible, though some plans may only have their deductibles applied to services provided in certain locations, such as hospitals or pharmacies. This is an important distinction to understand, as you may be subject to much greater personal costs for certain services just because of the location you use. For example, an x-ray may cost 5x more if you go to a radiology facility inside a hospital system, rather than an outside facility.

The out-of-pocket maximum includes the total amount of out-of-pocket expenses you can possibly incur in a benefit year. You should keep track of your receipts and payments throughout the year if you believe you may come close to this maximum. While “timing” your emergency healthcare needs is obviously impossible, proper planning or grouping of medical treatments to fit within the same benefit period could ultimately save you thousands of dollars by taking advantage of services received after meeting your annual maximums.

- Claim Summary

This section contains the meat of the statement and is probably the most important piece of information you need to review when you first receive your EOB. The claim summary details how much your provider is allowed to bill you for your claims, as well as why. If you have a service denied or marked as patient responsibility, for any reason, this section will give you the “Remark Code” that explains the reason and the part of your plan benefits used to process the claim.

The “Billed Amount” is irrelevant and you should probably avoid looking at this number – it will only scare you, as most providers, especially hospitals, bill insanely high amounts for your claims. These amounts are often far above what your insurer has contracted with your provider to offer their services for and essentially “phony” amounts used to justify over charging patients who are later found to be without insurance coverage. Instead, the “Allowed Amount” details the true cost of your care and the total amount of payment received by (or owed to) your provider for their services.

The Member Benefit section is supposed to detail how much having an insurance plan has saved you in health expenses, but is generally overblown because of the insane amounts originally billed. The most important section for patients, by far, is the Total Member Liability. This involves the summaries of your deductible, copayments, and coinsurances owed. If this number is higher than expected, you can see what rationale your insurer used to assign your benefits by checking the Remark/Reason Code, which matches up with the details at the bottom of the page.

This was just a basic summary of one EOB from one of our in-network insurers, BCBS of North Carolina, but the basic idea can be applied to any EOB and any format. This is the second post in a series on understanding the insurance claim process. In the rest of the blog posts in this series, I will explain the specifics involved in your EOB, including detailed information on the following topics:

- What is an Explanation of Benefits Letter?

- Basic EOB Terminology

- Determining Patient Responsibility

- Determining Plan Details

- Accessing Online EOBs

- Understanding Denials and Denial Codes

- How To File an Appeal

If you have any specific questions or topics you would like us to discuss, please mention them in the comments below and we will address them in future posts. If you are a patient at Family Care and have any questions about EOBs you received for claims from our office, please let us know by filling out our contact form. Thank you!