If you are reading this, you were probably directed by our staff to review our policies for self-pay / uninsured pricing discounts on laboratory services. We hope this will be a quick, easy-to-understand guide on how we can get the best price on your lab costs, regardless of your insurance coverage. There are a lot of ways your labs can be billed and the method that ends up costing you the least amount of money can vary based on your coverage, the tests you have done, the reasons you’re getting tested, and when you are able to make a payment. This should cover the majority of scenarios, but please let us know if you have any specific questions!

Three Ways Labs are Billed

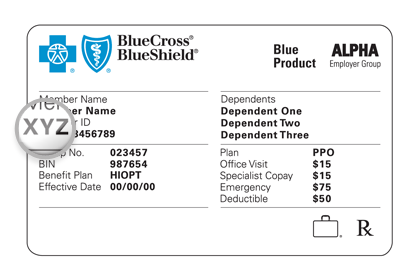

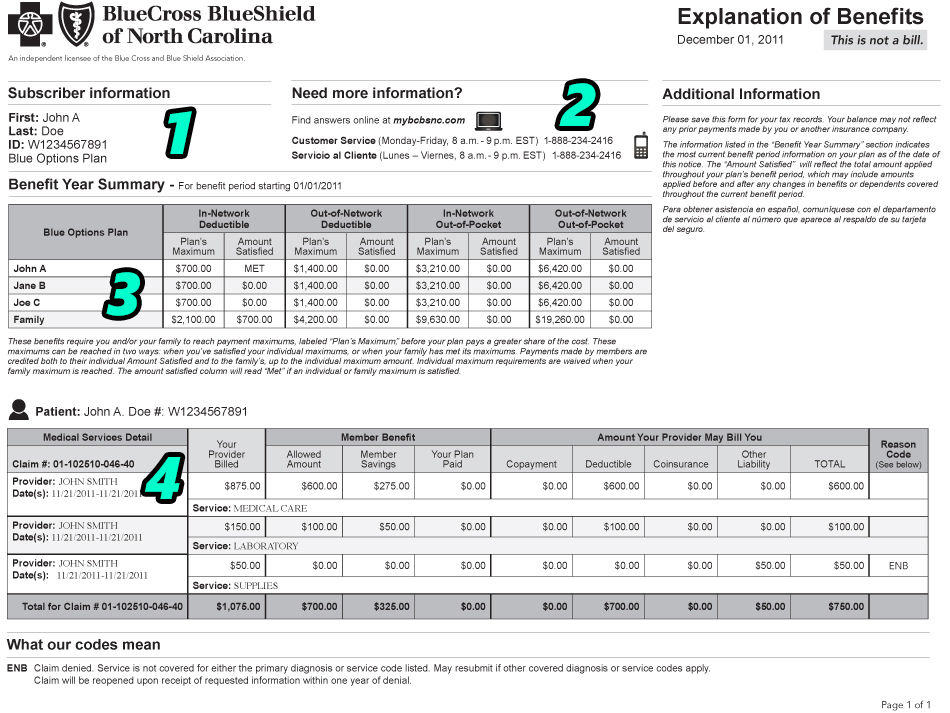

- Through an Insurance Company. If you have coverage, the lab submits diagnosis codes and procedure codes to your insurance and asks them to pay for your testing. Labs that are “covered” by your insurance will be payable at the insurance’s “Allowed Rate.” The Allowed Rate is a contracted price agreement between the lab company and your insurance, where your insurer agrees to pay the lab $X in exchange for performing a specific test.

- If the test is considered preventive, or if you have already met your out-of-pocket maximum for labs, your insurance will pay the Allowed Amount.

- Note: Your test will not be considered preventive if it is ordered outside of your Annual Wellness Exam. Preventive tests still need to be ordered for preventive reasons to be covered. (eg. you can order a Lipid Panel as a yearly cholesterol check or as a follow-up on hyperlipidemia. One would be preventive, the other is diagnostic, even though it is the same test.)

- If you have a lab deductible to meet, you will be responsible for paying the lab the Allowed Rate amount.

- If you have met your deductible, but not your out-of-pocket maximum, you will probably owe a coinsurance rate, usually 10-20% of the Allowed Amount.

- If your insurance does not cover a test, the Allowed Amount does not apply and the lab will bill you the Charged Amount.

- If the test is considered preventive, or if you have already met your out-of-pocket maximum for labs, your insurance will pay the Allowed Amount.

- Directly to Patient using the Lab Company’s uninsured pricing. If you don’t have insurance coverage or if your insurance doesn’t cover a test, the lab will bill you their full Charged Amount. If you agree to set up a payment plan with the lab, they will apply Uninsured Pricing discounts, which are usually about 40% lower than their Charged Amount.

- Directly to Patient through Family Care’s client pricing. If you know in advance that a test will not be covered by an insurance, the best method is to pay up front to Family Care at the time of service. The lab charges our office a Client Price, which is even lower than the Uninsured Pricing Discount.

As a general rule, if the Charged Amount for a certain test is $100:

- the Lab’s Discounted Uninsured Price will be $50

- the Family Care Client Price will be $20

- the Insurer’s Allowed Amount will be $10

I will be using these amounts in all examples, but please note that the rates vary significantly by test. This pricing structure is simplified, but the ratios are pretty consistent. Our discount with the lab is primarily based on volume, so specialty tests or tests that are not ordered frequently have less of a difference than standard, routine tests that we order often. If there is anything that is not listed in our Self Pay Prices, we can provide a quote for you within a day or two.

The Problems

Unfortunately, it is not always as simple as “just give me the lowest number.” The company you pay, when you pay them, and how they filed with an insurance all matter when determining how a claim can be processed with the lowest out-of-pocket cost. There are a lot of situations where you can predict denials and uncovered expenses, but there is almost no way to avoid that potential entirely. Here are the problems and dead-ends you might experience while trying to navigate this system.

- If your insurance denies one test, but approves the others, we cannot just adjust the price of the one denied test. Often, someone will get a panel of ~5 different tests run through their insurance. Each test will be billed for $100, with 4 of them being covered by an insurance, discounted to the Allowed Rate, and applied to a deductible, so that the patient owes ~$10 per test. However, the 5th test was denied completely, leaving the patient with $100 owed for the one denied test + $40 owed for the four approved tests, for a $140 total bill.

- Once the claim goes through an insurance and they accept at least some part of the claim, we can no longer offer Client Rate pricing for any of the tests on the claim. Even though our rate for the denied test would have been only $20, we would have to switch the entire order over to a client rate, so you’d end up paying $20 x 5 tests, or $100, total. It could still technically save you money, but you’d be wasting coverage for four of the tests and not optimizing your final rates.

- If we were aware up front that the 5th test would be denied in this scenario (usually when someone is repeating a test that they had problems with before), we could split the tests into separate orders and then have you pay $20 at the time of service for the 5th test. We wouldn’t even attempt to seek insurance coverage for that test, and then try to process the other 4 tests normally through your insurance.

- If your insurance approves all tests, that is likely the best rate you can receive. If your insurance covers a test, but applies it to a deductible, the insurer’s Allowed Rate will be lower than any Client Price we can offer. Having something applied to a deductible unexpectedly isn’t ideal, but there are no options to further reduce the price if it was an accepted test. Unless you can convince the insurer to cover the test as preventive, the deductible rate is probably your best price.

- You need to request any discount through the lab. If something is denied, the lab will automatically bill you the full Charged Amount. To qualify for any type of discount program, you need to request it. We try to provide the lowest prices to our patients up front so we don’t run into any problems with the lab’s billing, but we cannot make any changes to your lab bill without your request. If the claim has advanced to the point where you owe the lab a large amount of money, you will need to follow the steps to resolve a lab bill listed here.

- You generally need to pay up front. There are a lot more options available if you make your payment up front. If we are trying to fix a denied claim or adjust a date of service from more than 7 days ago, we may be limited in how we can proceed. This does not mean trying is worthless if you didn’t know this up front, but the lab is generally a lot more flexible before the test has been performed.

How to Get the Lowest Cost for Labs

If you have insurance…

- Verify your coverage for preventive services. At your annual wellness exam, request the tests that your insurance considers preventive and ask that they be included as part of your annual wellness exam. If you want a test that is not considered preventive, or if you attempt to have these tests done outside of your annual wellness visit, you will likely owe a lab deductible amount for the tests. Still, this allowed rate will be the lowest price option available to you.

- Verify if a test is considered a “Covered Service” under your plan. The term COVERED and PAID are not the same – your insurance can say they “cover” a test, but that just means that they will allow your benefits to apply to the claim. If you have a lab deductible to meet, you will still end up paying out-of-pocket for “covered” services. If a test is not considered “covered,” you will not receive any type of Allowed Amount insurance discount and be responsible for the entire Charged Amount.

- Remember to clarify the slight distinction between these terms when you speak with an insurer:

- COVERED / APPROVED / ALLOWED – These terms mean that it is an available service on your plan. Your plan will approve a claim for this service and apply your plan’s benefits towards potential payment. It DOES NOT mean that it will be paid by your insurance. If you have a deductible, you will still owe the Allowed Amount for a “covered” service.

- PAID – This is what you’re going for. You want your insurance to actually PAY for a service, not just give you the right to pay for the service at a lower rate. Discounts are nice and all, but $0 out-of-pocket is better!

- You want to ask “Is this lab paid as preventive?” rather than “Is this lab covered as preventive?”

- Remember to clarify the slight distinction between these terms when you speak with an insurer:

- Verify the diagnosis codes that your provider will use to file your claim. If the code starts with a Z, your provider is ordering it as preventive. If it starts with anything else, your provider is ordering the test as diagnostic. Services considered “preventive” by your insurer will likely be Paid, if the provider bills them as preventive. Non-preventive tests will only be Covered if a non-preventive diagnosis code is used, but you will most likely owe some type of lab deductible for the tests.

If you don’t have insurance…

- If you don’t have insurance at all, there is nothing really to consider. There is no hope for coverage, so you just want the lowest rate possible up front. That would usually be the Family Care Client Price, since we’re able to pass along a better deal than the lab will give you.

- You should request a Client Price up front and make payment to Family Care prior to having your labs drawn for the easiest process.

- If you pay up front for the lab and still receive a bill from Quest Diagnostics, please do not pay this bill and notify Family Care. We will resolve the error.

- For full disclosure, we earn roughly $5 per test billed at our Client Price. For example, if we bill you $20 for a test, our true cost to the lab on your behalf is probably around $15. We add this fee for the work necessary to process these changes and also allow for some of the risk involved in taking on unsecured patient debt. Considering the lab likely billed you around $50 for the same test, we feel like this is a good compromise for everyone and helps reduce costs significantly for uninsured patients.

Our goal is to reduce patient costs at all levels. Focusing on proper lab billing procedures is the easiest method for significant, easy-to-fix changes that result in lower out-of-pocket expenses for our patients. When in doubt, contact Ryan with your situation and we can provide customized advice to help make sure you receive the best price.