What to do if you received a bill from a lab for services rendered at Family Care, PA.

If you are reading this, you probably received a bill from a lab and had a question, so you were directed to this blog post for answers. There are a few pieces of information you’ll want to collect before determining if the bill is accurate.

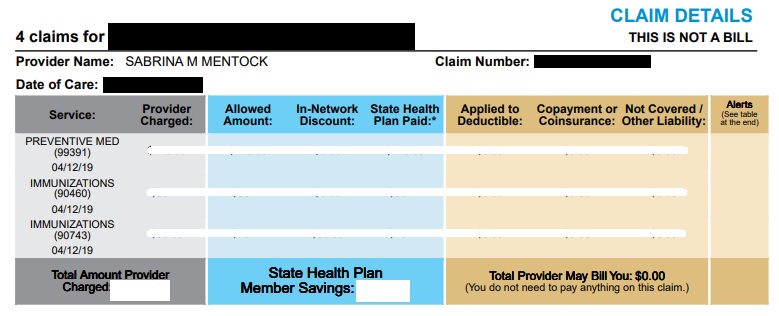

Check the Explanation of Benefits (EOB) letter from your Insurer. For any claim against your health insurance, you will receive a statement of benefits from your insurer after the claims has been processed. This is an insurance-side verification document to be sure you are being billed the proper amount from the rendering facilities. This document also explains why something wasn’t covered – in many cases, the reason is something that can easily be fixed once you review the explanation and compare the result to your plan’s details.

Seriously, check your EOB. This step answers 90% of the questions by itself and helps answer the other 10% much faster. Please take the time to find and evaluate a paper or electronic copy of this document before asking questions or paying a bill.

- Check statement dates. If your EOB shows the claim was processed after the bill was generated, you may receive an updated bill to reflect the changes.

- Check denial codes. If something wasn’t covered, the EOB will tell you why. If you disagree with the reason and think it should have been covered differently, you still have a chance to fix or appeal the denial. If the denial reason makes sense, you’ll likely owe that amount.

- Check each line item. Often, large bills are the result of a single, uncovered service, among a set of otherwise covered services. Narrow your focus on the specific line items that need to be fixed in your appeal.

If your insurer does not have record of the claim (eg. there is no EOB), then the lab did not file your claim with your correct insurance. You will need to contact the lab to update your insurance information and have them re-file the claim.

Find the portion of the EOB that states your patient responsibility. Based on the denial reasons stated in your EOB, we may have the potential to appeal and/or re-file your claim to have it re-processed by your insurer. If you think there is something that should have been paid, this annotated portion of your EOB will give you a clue as to why the service was denied. From there, we have a few options. In order of most likely, here are a few of the common situations we encounter:

Amount applied to deductible.

This probably means the reason/diagnosis used for the testing was not considered a preventive code. If your bill shows a primary diagnosis code starting with a Z, it was probably filed as preventive. If not, many plans have a lab deductible to meet prior to covering non-preventive services. If you believe the service should have been considered preventive, read this information regarding preventive wellness services and/or check your insurer’s benefit package to verify potential coverage.

Coinsurance owed.

Even after you meet your deductible, many plans still have a coinsurance percentage that will apply to lab services. Instead of paying 100% prior to meeting your deductible, you will pay a smaller portion (usually 10% or 20%) until you reach your out-of-pocket maximum. Basically, if your insurer allows $10 for a service, you can expect to pay $1. If you have not yet met your out-of-pocket maximum, you should expect to owe some amount for all non-preventive services.

Non-covered services.

This service is not considered a part of your insurer’s benefits package. This is rare, but it does happen. In certain cases, mostly regarding lab procedures, the lab and/or your provider may not be allowed to bill you for non-covered services. Always contact the rendering provider of any non-covered service within 2-3 weeks of receiving your EOB to verify your claim’s status to be sure. For services that are ultimately considered non-covered and billable, we can potentially have you pay our uninsured prices, rather than paying the lab directly.

Still have questions?

If you have gone through these steps and still have questions, we would be glad to help! Please include a copy of your EOB, a copy of the bill you received from the lab, and any information you have learned so far from your discussions with your insurer and the lab. This information will be needed to solve whatever complication you’re having with your claim. Good luck!