Determining Plan Details

One of the most common problems that people experience with their health insurance is the frustration of having to pay out-of-pocket for a service or prescription that they thought would be covered by their insurance plan. “I thought that was covered” is a common phrase with patients and most of the negative perceptions of health insurers stem from the general distrust that this reaction causes. People are skeptical about insurers covering certain things because they have been burned in the past and see insurers as being greedy whenever they end up owing more than just their premiums for their healthcare expenses. While insurers do sometimes make mistakes and deny things that should be rightly covered (which you have the right to appeal), your insurance is usually processing your plan’s benefits exactly how they said they would when you signed up for the plan. They probably even have your signature on a sheet of paper saying you agreed to their terms. Sneaky, I know.

The problem usually begins because patients misunderstand their coverage and get surprised when they see the differences in benefits from what they thought they would have to what they actually have. The new Farmers Insurance commercials are really a perfect example. Knowing your coverage could influence your decision on where and when to get treatment and help you reduce your overall out-of-pocket expenses. It will also keep you from being surprised with unexpected bills or regretting services that you wouldn’t have done if you knew the cost. You may even change plans entirely because you realize your coverage is terrible, or if you are paying too much to have coverage for services you don’t need.

Because all plans are unique, it is impossible to make a single guide that covers everyone to determining your coverage. This post is designed to help you understand the thought processes and terminology behind determining your plan’s details so you can navigate through your own insurer’s information with a good idea of what you should be looking for.

Which health insurance plan do you have?

This is probably one of the first questions you’ll have to answer and is the starting point for all other questions you’ll be asked in every possible healthcare situation. When someone asks you what health insurance you have, what do you say?

There are two things your healthcare provider or pharmacist is always looking for when they ask this question.

- The name of your insurance provider. This is the most basic starting point and 100% necessary for your provider to determine your plan details. Examples include Blue Cross Blue Shield (BCBS), CIGNA, Aetna, United Healthcare, etc.

- The plan type and/or name of plan. This is the first subsection of the insurance provider and describes the plan option you chose when signing up with your insurer. Sometimes the plan has an actual name. Examples of BCBS plans include Blue Advantage, Blue Value, Blue Options, Blue Saver, State Employees Health Plan, etc. The plan could also only be described by letters, like PPO, HMO, POS, EPO, etc.

Depending on the situation, your provider might also need some additional information. Typically, you will be asked for the rest of this information if you are going to be receiving medical services or prescriptions, if you need a prior authorization for anything, or if you are being referred to another doctor.

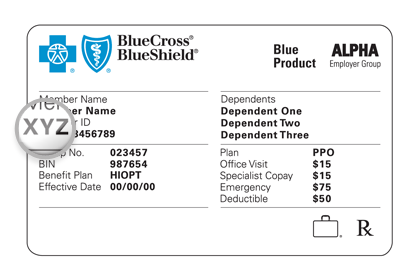

- Your Subscriber Number. This is the first basic identifier on your insurance card. It may also be called your Member Number, Identification Number, or something else similar. This is the biggest and most important number on your card, so it is probably highlighted in some way. If you have dependents on your plan, the Subscriber Number includes the two digit suffixes assigned to each dependent. For example, Dad could be ABCD0000-01, Mom could be ABCD0000-02, and Daughter could be ABCD0000-03.

- Your Group Number. This is usually the second most featured number on your insurance card and allows your provider to see which pool of subscribers has a similar plan. This is usually unnecessary for most purposes, but is generally required if you need a prior authorization so it is good to have on file. The group number also helps providers figure out your plan details when you have private employer-based plans or some of the more obscure plans available that they might not see that often.

- The Payer ID # or the Billing Address. This is necessary for billing your insurance, but most providers already know the proper way to bill your insurance provider and don’t necessarily need it if you have a popular insurance plan. If your plan is based out-of-state or if you have a smaller, more obscure plan, you will probably be asked for this information. The Payer ID # is a 5 digit number on the back of your card and should be somewhere near the Billing Address.

That information will help your provider process your claims, send referrals, and obtain necessary prior authorizations. It will not allow your provider to tell you how much you will owe for a service or what types of benefits you have on your plan. Knowing your basic plan details only guides your provider so they can use the proper channels to correctly process your insurance benefits – it will not help them predict what those benefits will be, or even if there are benefits allowed for a service, at all.

Because plan details can vary on an individual basis, it is impossible for your provider to predict your benefits with complete certainty. We process the claims at the time of service with every piece of verifiable information we have available, but there are always surprises.

For example, you may pay a $20 copay for your visit. Then, after your plan processes the claim and says you are not covered for that service, you find out that you are required to pay 100%, instead. This is why it is important for you to know your own coverage – you are the person that is impacted by how your claims are processed and are ultimately responsible for any surprises that happen with your plan, so it is best to avoid them!

What are my benefits for this service?

The primary thing everyone wants to know – how much do I have to pay for this? There are several methods you can use to figure out your plan’s details for a particular service and the types of benefits you can expect to receive.

- Look at your insurance card. This is a “snapshot” of your coverage and usually shows the most pertinent details of your plan. The problem with relying on this is the lack of detail and explanation for your coverage for specific services, or the types of exclusions or exceptions that may be active on the plan. With most plans, this shows what you’ll need for the majority of the services you’ll receive.

- Reference your enrollment paperwork and benefits package. Whenever you sign up for a new insurance plan, your insurance provider is obligated to send you a detailed package that includes your plan’s coverage benefits. This is usually sent within a couple weeks of your enrollment and may be updated each year with a new packet of information. Usually, there is a table of information included with three columns – the service type, the plan’s in-network benefits for that service, and the plan’s out-of-network benefits for that service. Whenever you visit a provider or facility, reference their section on this table to help predict what your benefits will be for that visit.

- Contact your insurance provider. On the back of your insurance card, there should be a customer service number that you can use to ask any questions you may have about your plan. They will always give you a standard “this call does not guarantee payment of services and benefits will be subject to the plan’s details at the time of service” spiel to make sure they aren’t promising coverage they can’t provide, but they should be able to tell you what your copayments or deductibles are and how they apply to certain types of providers and services. Most plans have online portals with customer service emails or live chats, as well, but the process is the same. You’ll want to contact your provider for the CPT Code they will use for the service and ask your provider specifically about your benefits for that code.

- Look at how previous visits processed under the same plan. Past coverage is a good predictor of future coverage, but only if the plan’s details have not been changed. If you had a $25 copayment for a sinus infection six months ago, and your plan has not changed since then, you will probably owe a $25 copayment for a sinus infection today. This could be a little problematic because it refers to your benefits at a previous date, rather than your benefits today, so make sure your plan details have not been modified since the service you are using as a reference.

- Just hope something is covered and deal with it later. This is probably the worst option, but it is usually the one most people end up choosing because they are either intimidated or frustrated or confused with the process for actually understanding their benefits. Because this experience just ends up perpetuating the “patient-versus-insurance” mindset, when the two should be working together towards the mutually beneficial goal of reducing the cost of healthcare, I hope this post helps people avoid this option!

This was a basic summary of ways you can determine the details on your insurance plan. This is the fourth post in a series on understanding the insurance claim process. In the rest of the blog posts in this series, I will explain the specifics involved in your EOB, including detailed information on the following topics:

- What is an Explanation of Benefits Letter?

- Basic EOB Terminology

- Determining Patient Responsibility

- Determining Plan Details

- Accessing Online EOBs

- Understanding Denials and Denial Codes

- How To File an Appeal

If you have any specific questions or topics you would like us to discuss, please mention them in the comments below and we will address them in future posts. If you are a patient at Family Care and have any questions about EOBs you received for claims from our office, please let us know by filling out our contact form. Thank you!