If your health insurance plan’s benefits involve some type of deductible, this article will help you understand the general terminology involved in your claims, how your charges are generated, the life cycle of a claim, and what to expect with this type of insurance plan. I have to answer a few other questions to get a fully detailed answer to “What is a deductible?” so I hope you don’t mind learning a few other things, as well! There will be too many words below already, so let’s get started!

TERMINOLOGY

I won’t waste space on the literal terms here because our in-network insurers do a good enough job with their dictionary definitions, here:

- Aetna: Explaining premiums, deductibles, coinsurance and copays

- BCBS: Health insurance deductibles

- Cigna: Copays, Deductibles, and Coinsurance

- United Healthcare: What’s a deductible?

These definitions don’t add much context to a real-life claims situation, so I’ve included a familiar scenarios to practically interpret or understand the terminology:

- Your PREMIUM is a set payment every month to your health insurance company for the right to have health insurance benefits. This is a fixed monthly expense that you owe for at least an entire year, regardless of how often you use healthcare services.

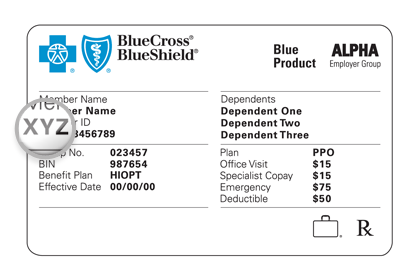

- Your COPAY is a static number that applies to certain types of consultations, usually PCP, Specialist, Urgent Cares, and sometimes also Emergency visits. Regardless of the length of visit or topics discussed, you always will owe this amount every time you have a visit.

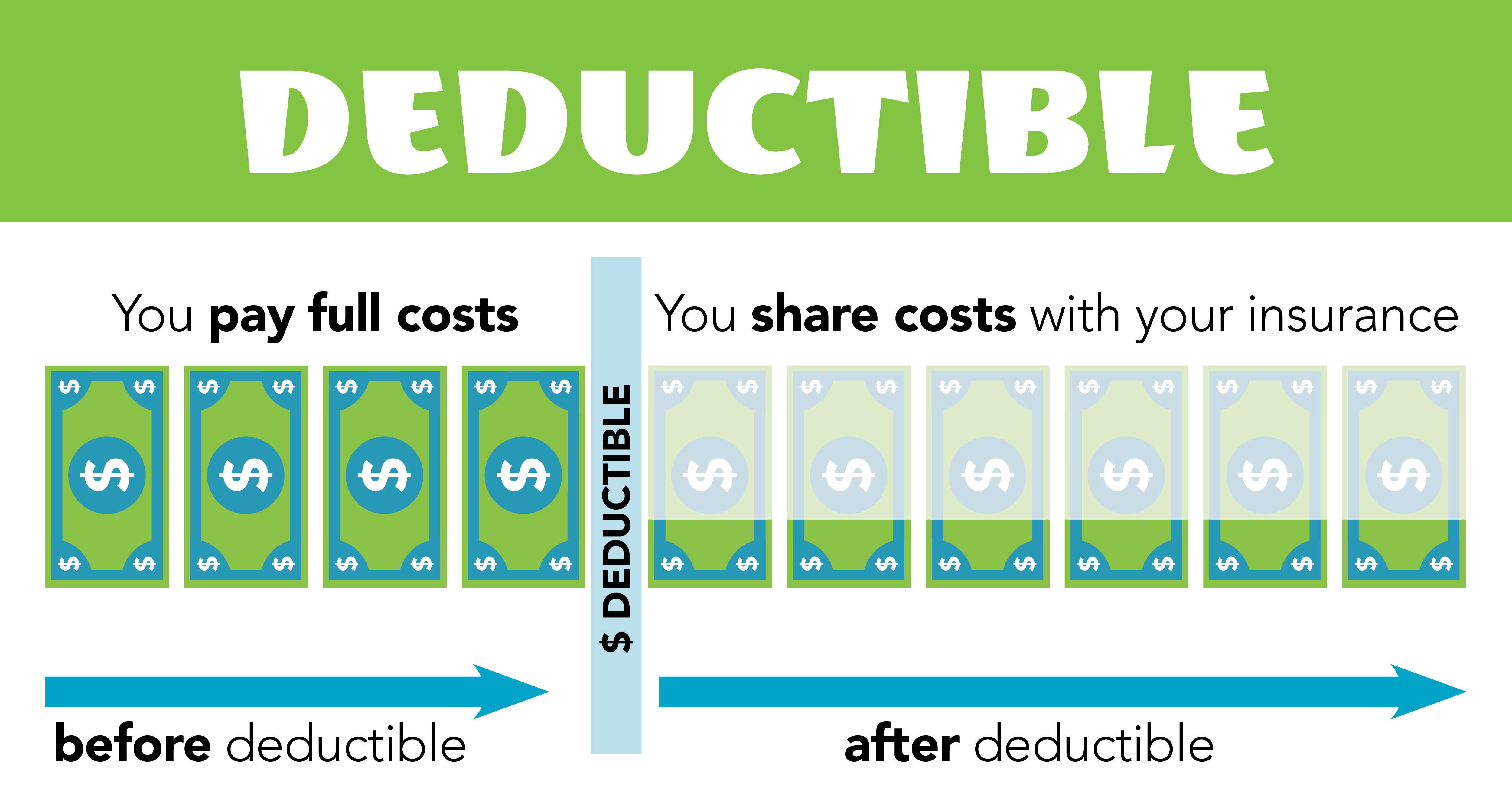

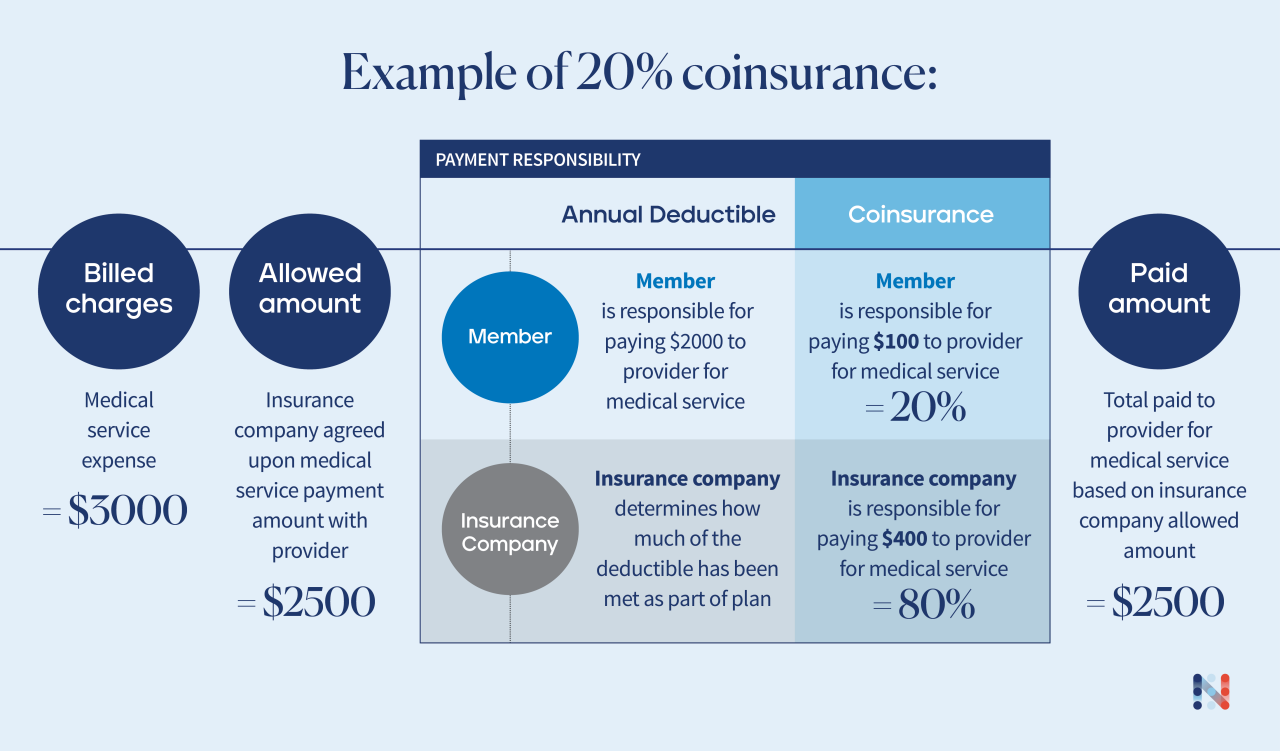

- Your DEDUCTIBLE is a variable number that sets an amount of medical expenses that the patient must pay for diagnostic services prior to the insurance company beginning to cover a portion of the same services. Most plans, even plans with Copays, have at least a small deductible for lab services and prescriptions, while others have deductibles that apply to all services.

- Your COINSURANCE is a variable percentage that applies to services incurred after your deductible has been met. If you owe 100% of services before your deductible, your coinsurance percentage is the amount you’ll owe after your deductible has been met. You’ll owe this percentage until you meet your Out-of-Pocket Maximum.

- Your OUT-OF-POCKET MAXIMUM is the total amount of expenses you can possibly incur for approved medical services over an entire benefit period. Unless you have charges that are non-covered, out-of-network, or otherwise excluded from your benefits (eg. employers not allowing employees coverage for weight loss products), this is the most you’ll pay.

Now that the terms I’ll use below are out of the way, let’s learn more interesting things!

HOW ARE CHARGES GENERATED

This is another topic that I spent ~5,000 words on already in this article, so I’d suggest clicking through to the original article if you would like more details.

Essentially, the total charge is comprised from 5 factors:

- Insurance Company and In-Network Status. Are you in-network or out-of-network? You’ll pay more for out-of-network.

- Benefits on Insurance Plan. Do you have a copay-based plan, deductible-based plan, or cost-sharing plan? That will matter.

- Length and Content of Visit. Was it a quick, easy visit, or a long, complicated surgery? Longer, more involved visits are generally more expensive.

- Preventive or Diagnostic Coding. Was the visit preventive, or diagnostic? Preventive visits are usually free, diagnostic visits are more expensive.

- Services Provided. Did you also have labs, procedures, vaccines, etc. with your visit? Those will add costs.

For a frame of reference, here is a listing of our uninsured prices for most services at Family Care. Each insurance has their own fee schedule and rate of reimbursement, but these are good ranges to expect for commercial insurances.

THE LIFE CYCLE OF A HEALTH INSURANCE CLAIM

It is important to understand the timing and steps involved in a health insurance claim process so you do not waste more time than necessary dealing with your insurer. It’s already terrible enough to call, knowing you’ll spend longer than necessary listening to the most annoying hold music science can create, and it’s even worse if you call for no reason. Basically, insurance claims require patience because they intentionally delay things on purpose to drive you crazy, so knowing where you are at in the timeline can save you a lot of stress!

These are the basic steps involved in a claim. A workflow diagram would probably be appropriate here, but this will have to do for now:

- The Visit (Day 0). This is the interaction where you received a billable medical service. This is thing you did that requires payment to a medical provider. You were probably sick that day, so I hope you’re feeling better now!

- The Claim (Day 7-10). Family Care waits 7-10 days to submit a claim to a health insurance, but this delay is not universal. The main reason that our office waits is to allow patients time to ask and address any follow up questions to their visit under a single billable encounter. This policy is designed to reduce overall patient expense and eliminates one of the barriers to positive outcomes by encouraging the patient to ask questions they forgot or notify our staff immediately if a treatment is not going well.

- The Patient Response (Day 24-40). This period is when you will first receive a statement from your insurer after having a medical visit at our office. An Explanation of Benefits (EOB) will have the first determination of coverage and explains how your benefits applied to the medical service you received. There will be a Remark Code that represents the coverage determination reasoning – if you owe any money for a medical service, this remark will explain why. It will probably be short and incomplete, which is designed to either make you misunderstand the reason or give your insurer a lot of wiggle room to explain how they applied their reasoning. If you disagree with any coverage determination, this is your head-start on fixing the issue before you receive an invoice.

- The Provider Response (Day 31-47). About a week after you receive your EOB from your insurance, your provider receives their own statement, called an Explanation of Payment (EOP). This is when our office would find out that you owe us money. This is essentially identical to your EOB statement, but with many other patients on the same file and fewer specific details on each patient’s individual benefits.

- The Invoice (Day 38-54). Within a week of our office receiving the EOP for your claim, you will receive an electronic invoice for any balances due. This will be sent to the email address we have on file for you. You will receive reminders every two weeks and start to incur late fees after 90 days, unless you are actively appealing a denial.

- The Appeal (Day 45-90). Insurers will consider coverage appeals within the first 90 days after processing a claim. If you disagree with the benefits applied to your claim, you will need to file a formal appeal. The appeal process is different for all insurers, but it should be detailed on your EOB from Step #3. If you appeal, please notify our office and we can help guide you to avoid wasting more time making unnecessary appeal attempts.

As a general rule, insurers take about 30 days for absolutely every decision. If you file an appeal, there is almost no point in following up within 30 days of the submission. You will likely just be told that it is in process and to call back again, so skip that step and just be patient!

WHAT WILL ACTUALLY HAPPEN WHEN I VISIT MY PROVIDER

Terms and theories are great, but knowing what will actually happen to you is better! These are basic examples of three common situations – you owe a deductible balance that you agree with, you owe a deductible balance that you disagree with, or your claim is denied completely.

In all of these scenarios, you would have already received some type of medical care and have an insurance plan that features a deductible-based benefits plan.

- Deductible Owed (Correct).

- If you receive your EOB and agree with the balance due, you just need to pay your bill! If you already paid at the time of service, you’re probably done with the transaction. If you have not yet paid, you should expect a bill in about a week. This should be what happens >95% of the time.

- Deductible Owed (Incorrect).

- If you receive your EOB and disagree with the balance due, there are two probable reasons why you disagree:

- The EOB says you owe less than you were billed, or less than you already paid. There are a lot of reasons this could have happened, but as long as everything that was denied was a “covered service” it likely means you’ll end up with a credit or refund back from your provider. In most cases, you likely met your deductible either before or during the claim in question, when it is generally impossible to tell which claims insurers will process first. You’ll end up owing the same deductible amount, but the provider that you have to pay that amount to might change based on the timing of the claims.

- The EOB says you owe more than you were billed, or more than you expected to owe. Similarly, there are also plenty of reasons this could have happened. There will be a remark code underneath the claim table that explains why something was denied or not paid. Depending on this reasoning, you can either review your coverage with your insurer or review the claim’s coding with your provider.

- If you receive your EOB and disagree with the balance due, there are two probable reasons why you disagree:

- Claim is Denied.

- This is a light grey area where the total you might owe the provider is the same, but you are not getting credit towards your deductible.

- eg. A denied service costs $100. Your provider bills you $100. If it was covered, your $5,000 deductible would then go down to $4,900, saving you $100 by the end of the year. If it was denied, the charges don’t get applied to your deductible and you still owe $100, so it’s basically like having a $5,100 deductible at that point. Obviously, that is worse.

- In general, you’ll want all charges to be “approved,” even if you end up having to pay for them. The denial remark codes will explain your next possible steps towards getting a denied service reversed and approved.

- This is a light grey area where the total you might owe the provider is the same, but you are not getting credit towards your deductible.

When in doubt, contact your provider. We usually receive our version of your claim statements about a week after you do, so don’t freak out immediately when receiving a scary EOB. We can definitely get started on fixing issues before we receive our own statements, but just remember that we might not yet be aware something went wrong with your claim and will need a bit of time to help identify the issue. There is a general strategy to fixing every type of problem, but understanding what those problems look like and identifying how they happen should hopefully provide the tools necessary to defeat your insurance denial and receive the most from your insurance benefits.