What is a “grandfathered” health insurance plan?

A grandfathered health insurance plan means that the plan does not have to follow the national healthcare reform guidelines implemented by our federal government as part of the Patient Protection and Affordable Care Act (ACA) in March 2010.

There are two types of grandfathered health insurance plans:

- Job-based grandfathered plans. Job-based grandfathered plans can still maintain their grandfathered status if the plans haven’t been changed in ways that substantially cut benefits or increase costs for plan holders and notify plan holders that they have a grandfathered plan. To keep a job-based grandfathered plan, the employer must have continuously covered at least one person in the company since March 23, 2010.

- Individual grandfathered plans. Individual grandfathered plans can’t newly enroll people after March 23, 2010, and have that new enrollment be considered a grandfathered policy. But insurance companies can continue to offer the grandfathered plans to people who were enrolled before that date. An insurance company can also decide to stop offering a grandfathered plan. If it does, it must provide notice 90 days before the plan ends and offer enrollees other available coverage options.

While the majority of stipulations in the ACA apply to all types of health insurance plans, grandfathered plans are allowed to maintain a lower standard of coverage as a political compromise towards meaningful reform. With their grandfathered status, these plans have a different set of requirements:

All health plans, including grandfathered plans, must:

All health plans, including grandfathered plans, must:

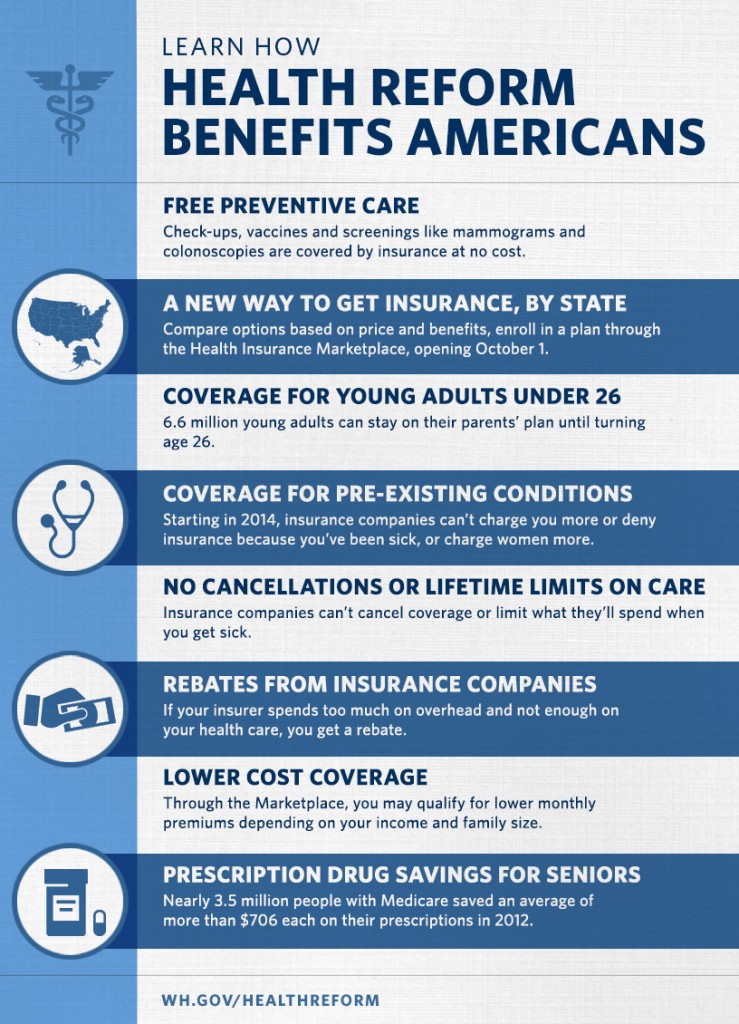

- End lifetime limits on coverage

- End arbitrary cancellations of health coverage

- Cover adult children up to age 26

- Provide a Summary of Benefits and Coverage (SBC), a short, easy-to-understand summary of what a plan covers and costs

- Spend the majority of your premiums on health care, not administrative costs and bonuses

- Grandfathered plans DO NOT have to:

It is important to understand the reasoning behind the changes made with the ACA and why our government had to do something to fix a broken system before it was too late. Before the ACA took effect, health insurers had a completely disproportionate advantage on the patient/insurer relationship. These healthcare reforms have been long overdue and were actually set up to help patients regain control from health insurers, no matter what other motives you might hear on Fox News. It is named the “Patient Protection” act, after all. You may remember some of the many ways health insurers ripped people off before the ACA:

- If you got sick, your insurer could cancel your coverage. What good is having coverage while you’re healthy if you’ll just get dropped when you’re sick?

- Your insurer could deny you coverage for pre-existing conditions, which included things as minor as acne and previously having a child.

- 129 Million Americans, or almost 50% of the country in 2010, were at risk of losing their health insurance if they became sick or injured, with no contractual requirement for your insurer to actually pay for continued care.

- Your insurer could impose lifetime maximums on coverage that were often less than the amounts in premiums patients had paid over their own lifetime.

Do any of these ideas sound fair to you? Obviously not. I think we can all agree that putting a stop to these devious insurance practices is a good thing for the healthcare industry, overall.

Despite the obvious benefits of having an ACA compliant plan, it does make sense for some people to continue coverage under a grandfathered plan. However, 3 out of 4 people with employer-based health insurance have an ACA compliant plan, along with almost everyone who is insured through the individual marketplace, so having a grandfathered insurance plan means you are going to face challenges and issues that do not apply to most of the population anymore, thanks to the ACA. Here are a few closing points to consider:

- The majority of the advertisements, articles, new stories, and policy discussions that you see in the media regarding healthcare do not apply to you.

- Your out-of-pocket costs will most likely be significantly higher than someone with an ACA-compliant plan.

- Your “preventive wellness exam” is not covered by your insurance. If you have a copay or deductible, those will still apply to this visit.

- You do not have the right to appeal any decision by your insurer. This includes denials for prescriptions, imaging, and medical claims.

Patients Asked Thrice: Healthcare Insurance and Billing Q&A

This post is part of a series entitled “Patients Asked Thrice,” which is designed to answer questions I have received at least three times from our patients. The inspiration comes from the saying: “One’s an incident, two’s a coincidence, and three’s a pattern.” If three different people ask me the same thing, I can safely assume there is at least a fourth person out there who wants to know the answer.

If you have any other questions you would like me to address, or any follow up questions to this post, please include them in the comments section below. Thank you!