How are charges determined for primary care services?

If you call to ask any medical office about prices, you’ll probably find that nobody is able to give you a direct answer. “How much will my visit cost?” will always be answered with some version of “it depends.” While that answer is true, a better answer might provide an estimate or range or an explanation about how those charges are generated. I’m hopeful that this article will be the best answer to that question you’ll ever receive.

This is a breakdown of every factor that goes into determining how much you are charged for a certain primary care medical service. These examples are related to primary care charges, but should translate well to specialist and urgent care charges, and at least provide a baseline of understanding for hospital-based charges.

- Insurance Company and In-Network Status.

- Benefits on Insurance Plan.

- Length and Content of Visit.

- Preventive or Diagnostic Coding.

- Services Provided.

INSURANCE COMPANY AND IN-NETWORK STATUS

As often as possible, you’ll want to visit providers that are “in-network” with your insurance. Being in-network means your provider has a contract in place with your insurance company to accept payment from your insurer and help you receive the benefits under your insurance plan.

Part of signing a contract with an insurer is agreeing to a “contracted rate” for medical services. This rate is determined through negotiations between the insurer and your provider, with some providers able to make deals for higher pay for the same services. Larger practices and hospital-affiliates can use their scale to negotiate better terms on their deals. Basically, they can get paid more for the same service because the threat of the large hospital leaving the network is greater than the threat of a small, independent practice leaving the network.

- Family Care receives roughly $70 for a 99213 from Aetna, one of our most used office visit codes. The closest large hospital-based primary care to our office receives ~$110 for the same code. If you have a deductible to meet for primary care services, you’ll be paying $70 at an independent facility or $110 to the large hospital for the same type of visit.

This contracted rate also varies significantly from one insurer to the other. Going back to CPT Code 99213, here is a range of rounded prices from various insurers at Family Care for the same code:

| CPT | Aetna | BCBS | Cigna | United Healthcare |

| 99213 | $70 | $85 | $75 | $70 |

BCBS allows higher reimbursement for the same service than most other insurers, mostly because they also have stricter standards for quality and claim management in their provider networks and provide a lot better coverage for services than other plans. However, two people that received the same service can be charged different amounts, based on the contracted rate that your provider has in place with each insurer.

If you go out-of-network, the provider is technically allowed to charge you whatever they want! There are a few requirements for limiting charges, but you’re essentially operating outside of any contracts and subject to whatever rules the provider has in place. At Family Care, we offer uninsured or out-of-network patients the same rate as our lowest paying insurer. At large hospital facilities, they’ll double the price and act like they’re doing you a favor by giving you a 10% discount.

Summary: In-network providers sign contracts to follow rules that protect the patient and allow you to access your insurance benefits, so stay in-network. Larger facilities cost more, and contracted rates vary based on the insurance company.

BENEFITS ON INSURANCE PLAN

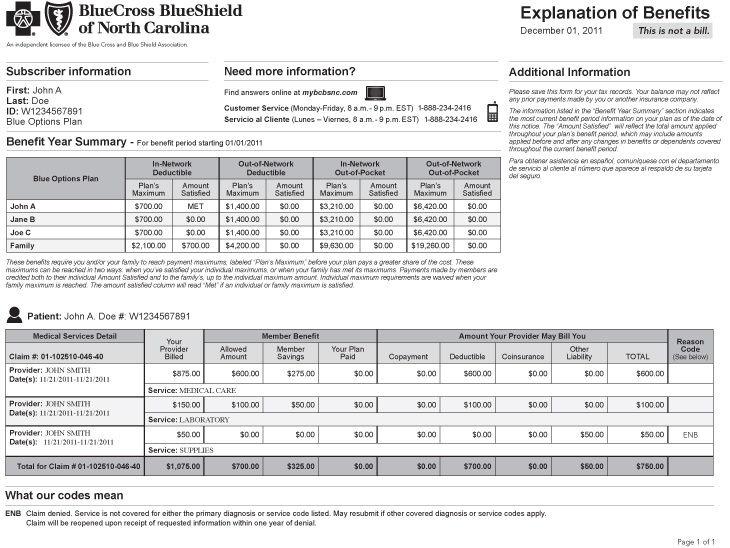

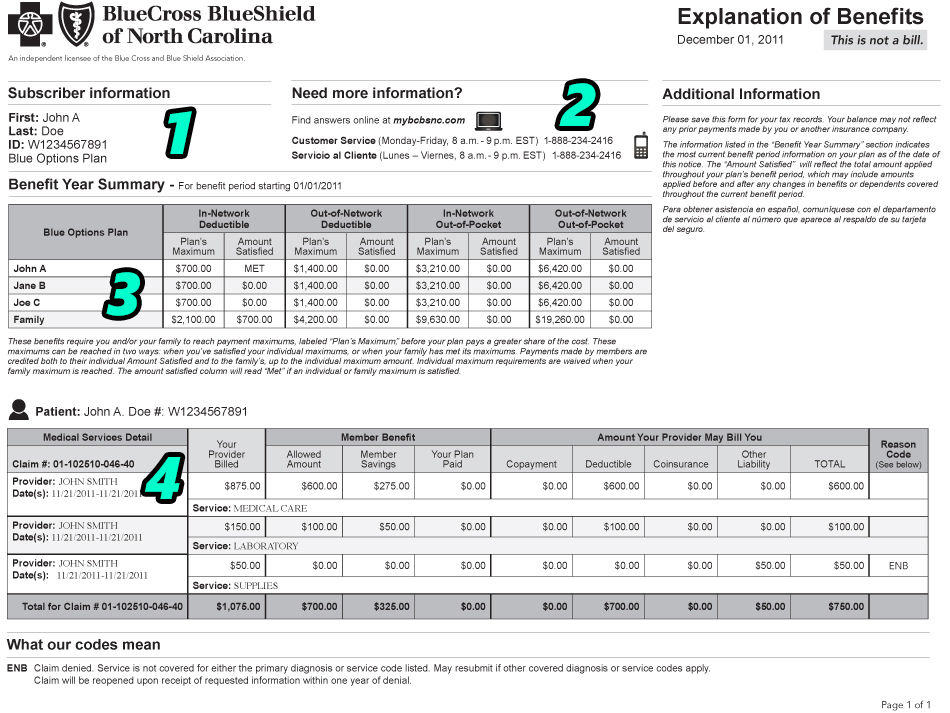

We just covered an aspect of the charges that is beyond your control – the negotiated rate between your insurer and your provider. This section is related to how charges are assigned between the two parties that will pay for your healthcare expenses – either the patient or the insurer. The final answer is determined based on the benefits on your insurance plan and the contract you signed with your insurer.

These days, there are two main types of plans you can decide from:

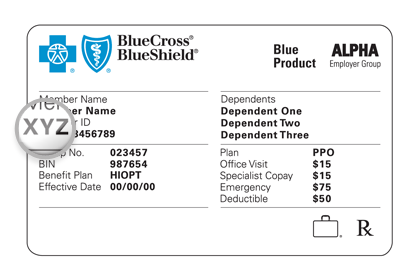

- PPO / “Copay” Plan: This plan has higher premiums, but you pay less when you need care.

- Deductible-Based Plan: This plan has lower premiums, but you pay more when you need care.

There are lots of options in-between these two choices, but we’re going to be over 5000 words with this article already and the exceptions could fill a book, so we’re just going to simplify things and focus on these two most common options.

If you have a Copayment for primary care services, your costs are essentially fixed. Every time you visit your primary care provider, you’ll likely owe a $X copayment. You’ll likely have a deductible for non-standard services, labs, and procedures (eg. minor surgeries, in-house diagnostic tests, EKGs, etc.), but you’ll know to expect a $X copay almost every time you seek care. Because those types of plans are fairly easy to understand and you don’t really need to worry much about factors that go into the total cost of your visit (because you only need to pay your copay, regardless of the amount of total charges), this article will be focused on deductible-based plans.

Under a Deductible-based plan, you pay 100% of all non-preventive medical charges until you have met your deductible. After meeting whatever deductible amount you have on your plan, your responsibility for future charges drops to a Coinsurance Percentage, usually around 10%-20% of all charges. This means you still have a variable rate of responsibility after your deductible, but it is calculated at a much lower amount. You will continue paying variable-rate bills at that lower percentage until you have met your Out-Of-Pocket Maximum (OOPM) for the year.

The benefit of a deductible-based plan is usually seen in your monthly premiums. Plans that cover more expenses (ie. Copay plans) are guaranteed to have higher fixed costs through monthly premiums, while plans that cover fewer expenses (ie. Deductible plans) are guaranteed to have higher variable costs based on usage. Here is a quick example of a three-month period for two different patients receiving the same care – one with a copay plan and one with a deductible plan.

| Patient | Plan Type | Premium | Visit #1 | Visit #2 | Visit #3 | 3-Month Total |

| Alice | Copayment | $700 | $25 | $25 | $25 | $2175 |

| Betty | Deductible | $350 | $125 | $75 | $225 | $1475 |

In this example, Betty had to pay $425 more to their provider for the same services that Alice received for only $75. However, Alice also paid the insurance company $2100, while Betty only paid the insurance company $1050 in the same period. Overall, Betty owed more to the provider when they sought treatment and medical care, but still saved a significant amount in total out-of-pocket expenses by having a lower fixed premium expense each month.

As I outlined in a previous BCBS State Health Plan article, there is always a point of usage where both plans match overall expenses equally. In general, the more health problems you have, the more you should want higher premiums and lower expenses for receiving care. You don’t want an unexpected cost to be the reason you don’t receive treatment, or a reason to avoid seeking the care you need. The promise of a set expense when receiving care is valuable and lowers barriers to treatment for many people who have chronic or complicated conditions.

On the flip side, if you do not have many health problems and don’t expect to require healthcare services often, you’ll want to save your fixed expenses each month and just save money until you need care. If you save $350 per month on your premiums, but must pay an extra $100 every three months to your provider, you’ll still be way ahead on costs, overall.

The trick is to figure out which side of the chart you’ll end up on and try to match your coverage accordingly. Every insurance plan can benefit someone, but the hard part is finding the insurance plan that benefits you, specifically.

Summary: The benefits on your insurance plan determine what percentage of the total charges you’ll be responsible for paying at each visit. Better coverage means higher monthly premiums, but lower expenses when you seek care.

LENGTH AND CONTENT OF VISIT

We’ve covered the “Insurer-Provider” and “Insurer-Patient” relationships that impact payment responsibilities, so this one is basically the “Provider-Patient” section.

For any service-based industry, time is money. If you hire a mechanic, plumber, landscaper, contractor, lawyer, or accountant, it is generally accepted that these professionals charge by the hour. The same is true for medical providers, with a few exceptions and requirements.

Primary care services fall under three main categories:

- Office Visits. Any discussion or consultation with a medical provider that results in the treatment, diagnosis, or management of a patient’s problem, concern, or illness.

- Preventive Services. Standardized screening services, as determined by the patient’s age, gender, risk factors, and family history. These are essentially “scripted” visits and do not necessarily consider a patient’s individual medical history when being performed.

- Lab Services. Samples and specimens collected to obtain preventive or diagnostic lab results.

For Office Visits, you will be billed based on time and complexity of the visit. Short, simple appointments are cheaper than long, complicated appointments. Family Care utilizes coding calculators to provide accurate charges for services, which follows the current AMA recommendations and requirements for medical decision making outlined here. The entire table is a great resource, but here is a quick summary of our 4 most common codes, the non-preventive codes used for standard consults/problems/issues:

- 99212: 10-19 minutes, minimal complexity, minimal risk

- 99213: 20-29 minutes, low complexity, low risk

- 99214: 30-39 minutes, moderate complexity, moderate risk

- 99215: 40-54 minutes, high complexity, high risk

In general, your visit only needs to hit at least 1 of the 3 factors to reach each threshold. This is why time is the simplest way to understand the charges, but also why a short visit might end up being charged at a higher amount. For example, a 15-minute visit about acne would be a 99212, while a 15-minute visit about anxiety and depression might be a 99214. This difference is mostly related to the extra requirements we have from insurers and resources we must allocate to manage the higher complexity problems.

Keep in mind that the times listed are also not the amount of face-to-face time you see the provider, but the amount of time the provider takes to see you. Here is the definition of “time,” according to the AAFP:

The definition of time consists of the cumulative amount of face-to-face and non-face-to-face time personally spent by the physician or other QHP in care of the patient on the date of the encounter. It includes activities such as:

- Preparing to see the patient (e.g., review of tests);

- Obtaining and/or reviewing separately obtained history;

- Ordering medications, tests or procedures;

- Documenting clinical information in the electronic health record (EHR) or other records; and

- Communicating with the patient, family, and/or caregiver(s).

For most visits, especially chronic conditions, your provider spends at least 5 minutes before your visit reviewing your records, results, and preparing to speak with the patient about whatever problems you have presented with at your visit. After your visit, your provider will also spend at least 5 minutes (usually more) documenting your visit, sending prescriptions, writing referrals, and coordinating your care with specialists. Because of this, a 99212 is uncommon. Most visits take 15-20 minutes of face-to-face time and 5-10 minutes of prep / post time from your provider. It is rare that an entire problem can be introduced, diagnosed, addressed, and treated within just 19 minutes, but it does happen!

At Family Care, regular office visits are charged at a 99212 (shortest) or 99215 (longest) rate about 10% of the time each, at the 99213 or 99214 rate about 40% of the time each, so a 99213 or 99214 should be expected for most visits.

Summary: You are basically paying by the hour and complicated conditions require more time. Charges are generated by the provider’s total time spent preparing, administering, and documenting your healthcare, not just the face-to-face time spent with your provider. A short, simple visit will have lower billable charges than a long, complicated visit.

PREVENTIVE OR DIAGNOSTIC CODING

Instead of a “relationship” between the provider, patient, or insurer, coding guidelines are more of a regulation that providers must follow based on CDC and World Health Organization (WHO) guidelines. There are two codes that combine to determine the codes used for each visit – CPT Codes and ICD10 Codes. Each one of these codes has the potential to be used to represent preventive services or diagnostic services, which greatly change the likelihood of a particular service being paid for by an insurance company.

Preventive services are essentially screenings to identify any problems and make sure you are up-to-date on healthcare guidelines based on your age, gender, and risk factors (eg. Are you due for your mammogram?). I wrote a few thousand words about preventives services here, so I won’t go into that topic much here.

Diagnostic services essentially cover everything else, but can briefly be summarized as things that are related to health problems or concerns that are unique to an individual (eg. Knee pain, influenza, high blood pressure, etc.). Outside of your annual preventive exam and services specifically outlined as preventive under your insurance benefits, you should start with the default expectation that all services will be considered “diagnostic.”

CPT Codes are the answer to “what service did I have?” Each CPT code represents a different type of service that fits within the same standards for medical care and decision making. Every unique service is represented by a unique CPT code, with some groups of codes representing a service that is classified as “preventive.” Here are a few examples of how a CPT code works:

- Example A: Alice and Betty both see a doctor for an in-person visit and get an EKG performed during their exam. Both patients will have CPT 93000 added to their charges.

- Example B: Chris and Dave both have a lipid panel drawn to check their cholesterol. Both patients will be charged for CPT 80061 by the laboratory.

ICD-10 Codes are the answer to “why did I have that service?” Each ICD code represents the problem, issue, illness, or concern that explain why you sought medical treatment. Like CPT codes, ICD codes also have groups that represent a preventive or diagnostic service. The new ICD-10 system uses fun categories based on the types of problems each category represents (eg. If an ICD-10 code starts with the letter Z, it is considered preventive).

Now that we know what CPT codes and ICD-10 codes are, and the difference between preventive and diagnostic, I can explain how the relationship between these two codes ultimately determines your benefits. This table explains the possible outcomes:

| Preventive ICD-10 Code | Diagnostic ICD-10 Code | |

| Preventive CPT Code | Preventive | Diagnostic |

| Diagnostic CPT Code | Diagnostic | Diagnostic |

- If both the CPT and ICD are Preventive, the claim will be considered Preventive.

- If either the CPT or ICD are Preventive, the claim will be considered Diagnostic.

Going back to the previous examples, here is what would happen with different scenarios.

- Example A: Alice did not have any heart problems at her visit, but received an EKG because her insurance allows one screening EKG after she turns 65 years old. Betty has had two heart attacks in the past 5 years and was ordered to get an EKG by her cardiologist because he noticed a murmur. Alice’s EKG will be paired with a preventive ICD-10 code and be considered a preventive service. Betty’s EKG will be paired with a diagnostic ICD-10 code and be considered a diagnostic service.

- Example B: Chris has never had problems with cholesterol before and had his lipids checked as part of a routine annual wellness exam. Dave has a long history of cholesterol issues and was recently admitted to the hospital for heart failure. Chris’s lipid panel will be paired with a preventive ICD-10 code and be considered a preventive service. Dave’s lipid panel will be paired with a diagnostic ICD-10 code and be considered a diagnostic service.

The same service is provided, but the pairing to designate “preventive” or “diagnostic” will ultimately determine which class of benefits the charges are considered under.

Summary: CPT codes are the “What” and ICD-10 codes are the “Why” for any insurance claim. If both are preventive, the claim will be preventive. If one is diagnostic, the claim will be diagnostic. The same service can be considered either preventive or diagnostic, depending on why it was ordered.

SERVICES PROVIDED

We’re close to 3000 words already, so we’re lucky that this section is short and easy! If you have something done, you’ll be charged for it. If you don’t have something done, you won’t be charged for it. Simple!

To make this short section helpful, here are a few examples:

- Visit A: 20-minute visit, only. $100.

- Visit B: 20-minute visit, plus a flu test. $125.

- Visit C: 20-minute visit, plus a flu test, plus a vaccine. $225.

The more things you have done, the more you will be charged. Think of it sort of like a restaurant menu and ordering different items, except those items are different services.

In primary care billing, there are only about 25 codes that are used with any frequency. Things can get complicated with hospital services, visits that require multiple providers or specialties, or when any drugs are administered, but thankfully we can pretty much list every code we’ve used more than once per year.

These codes are our basic uninsured rates, so they do not consider the network contracted rates that are described in the first section of this article. Generally, these listed prices are within 10% of our average, so it can be used as a good estimate.

Summary: There is a separate fee for every service, test, vaccine, or treatment you receive. If you have more things done, you will pay more in total.

FINAL SUMMARY

Medical billing can be complicated, but there are some basic concepts that should help you work out any problems or discrepancies and help you predict your cost of care. If you understand your insurance benefits and how your charges are generated, you shouldn’t be too surprised by any one charge. Understanding these concepts will also help you speak with your insurer or provider to dispute any discrepancies or file an appeal. Getting guaranteed medical billing information up front is difficult for a lot of reasons, but I hope this information helps establish an estimate for charges under any type of insurance plan and provides a framework for patients to understand their coverage and charges better.

If you are a patient at Family Care and have any questions about this information, please contact Ryan!